What is a Shelf Corporation?

A shelf corporation, also known as an aged or dormant corporation, is a business entity created but not yet engaged in any business activities. These companies are "sitting on the shelf," ready for purchase by entrepreneurs looking for an established corporate history. They have all the necessary legal documentation and have maintained compliance with state requirements despite minimal operational activity.

Pre-established legal existence: Already registered with appropriate government agencies.

Corporate history: Has existed for a set period of time (months or years)

Minimal activity: Generally has no significant assets, liabilities, or business operations

Complete ownership transfer: Sold with all formation documentation to new owners.

WHY CONSIDER BUYING A SHELF CORPORATION?

POTENTIAL BENEFITS

Instant Credibility: Enhances credibility with clients, suppliers, and creditors immediately.

Easier Access to Funding: Older corporations are often viewed more favorably by lenders, potentially increasing loan approval chances.

Immediate Business Opportunities: Skip lengthy startup processes and capitalize on time-sensitive opportunities.

Contracting Requirements: Meet minimum age requirements for certain government or corporate contracts.

Banking Relationships: May facilitate establishing banking services more quickly.

IMPORTANT CONSIDERATIONS:

Regulatory Scrutiny: Shelf corporations face increasing oversight due to potential misuse.

Due Diligence Required: Thorough investigation needed to verify clean history and absence of liabilities.

Industry Limitations: Some regulated industries have restrictions on using purchased entities.

Ongoing Compliance Costs: Annual fees, back filings, and maintenance requirements.

Transparency Issues: May raise questions with partners or investors if not properly disclosed.

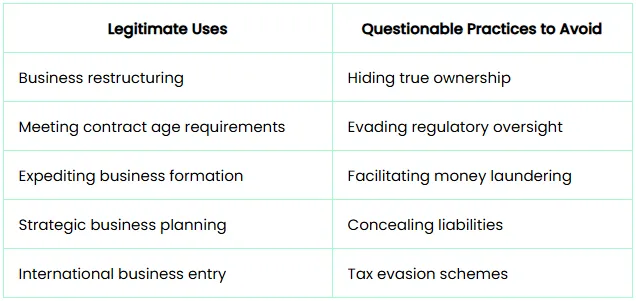

LEGAL AND ETHICAL CONSIDERATIONS

While shelf corporations are legal in most jurisdictions when used transparently, they should be approached with careful consideration of compliance requirements:

MBA Capital Team strongly recommends consulting with legal and financial advisors to ensure compliance with all relevant regulations when acquiring a shelf corporation.

HOW DO YOU PURCHASE A SHELF CORPORATION?

Research reputable sellers with verifiable credentials and history.

Review the company's complete history, financial records, and compliance status.

Conduct a thorough due diligence investigation for any potential liabilities.

Verify tax compliance and good standing with state authorities.

Complete the paperwork for ownership transfer with proper legal guidance.

Update registered agent information and other corporate records.

SHELF CORPORATION OFFERED BY MBA CAPITAL TEAM

All our Shelf Corporations are at least four years old and registered in either Minnesota or Colorado. If your're located elsewhere, you can easily perform a foreign filing in your state.

WHAT SETS OUR SHELF CORPORATIONS APART:

Comprehensive compliance history with all state requirements

Clean legal standing verified through multiple channels

Complete transfer of all corporate documentation

Ongoing support through the transition process

Consultation on regulatory requirements in your jurisdiction

ADDRESS OPTIONS AVAILABLE:

Option 1: Get a virtual business address in the corporation’s state, with mail forwarding to your home after business credit approval.

Option 2: Use your own address and perform a foreign filing (may incur extra fees), enabling business credit correspondence directly to your chosen location.

COSTS BEYOND THE PURCHASE:

When considering a Shelf Corporation, be aware of these additional potential expenses:

Annual state filing fees

Foreign qualification costs if operating in multiple states

Registered agent services

Tax preparation and compliance

Business license updates

Banking fees for new account establishment

IS A SHELF CORPORATION RIGHT FOR YOU?

While purchasing a shelf corporation offers clear advantages for some business situations, it’s not the right solution for everyone. Consider your specific business needs, industry requirements, long-term goals, and budget constraints carefully. Alternative options such as business credit building programs or traditional entity formation may better suit your needs in some cases.

MBA Capital Team offers complimentary consultations to help you determine if a shelf corporation aligns with your business objectives.